LifeGuideŽ is produced for installation under Windows 95/98/ME, Windows

NT/2000 series and Windows XP.

LifeGuideŽ is fully Network Compatible for installation under various

network configurations (Network installation licensing is required for

network installations.).

The LifeGuideŽ Professional software is produced independently of all

insurance sales and marketing organizations, without any direct or

indirect affiliations with any insurance marketing organization.

The primary focus is to benefit the insurance buying consumer in the

most objective, complete and professional manner. As a

consequence, LifeGuideŽ subscribers enjoy the widest and continuously

increasing service and competitive edge and advantage.

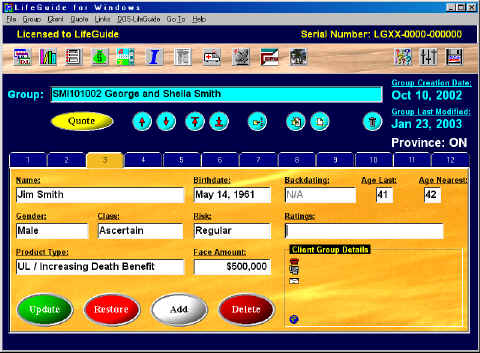

Picture of the opening screen of the LifeGuide Professional Software

Scope and Range of Products Researched and Compared in

LifeGuideŽ

The LifeGuideŽ Professional Software covers the entire range of life

insurance products. No other independently produced life insurance

research, comparison and information software in Canada provides the

number of products, the number of companies and the level of

comprehensive research and comparison facilities, features and tools

that are provided to professionals on the LifeGuide software. The range

of products on LifeGuide includes:

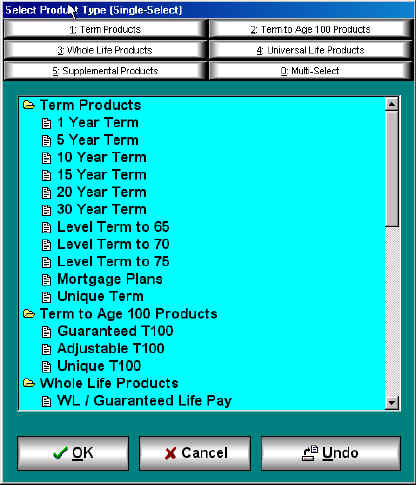

The "Products' Selection" pop-up window of the LifeGuide Professional

Software. This pop up window provides the user with the product options

from among the largest number and widest scope of Term, T100, Whole

Life, Universal Life, Critical Illness, Guaranteed Issue and Special

Issue products. It is as easy and point and click.

-Term Life Insurance: All available forms of

"term" life insurance, including YRT, T5, T10, T15, T20, T25, T30, T65

and T75, etc. Term insurance is researched, compared and quoted for

single lives, on a joint (first and last to die basis) as well as for

multiple persons using LifeGuide's unique Multi-LifeŽ cost optimization

functions. Additional functions for research and comparison of term

insurance include fine tuning and filtering of term products with

respect to renewability and convertibility, fine tuning of research to

account for the various category-classes, including consideration of

the various forms of past or present tobacco use (and time since last

use), detailed qualification requirements, detailed underwriting

evidence requirements, detailed plan descriptions, insurance company

profiles, marketing information resources listings and instant access

to sample policy wordings, etc. LifeGuide provides subscribers with the

most comprehensive and most advanced term research and comparison

tools.

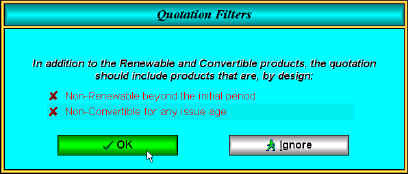

The "fine tuning" 'filtering' pop-up window of the LifeGuide

Professional Software for Term products' research and comparisons.

Since renewability and convertibility may be important qualitative

aspects of Term products, LifeGuide provides the user with the facility

to filter the compared products on the basis of renewability and

convertibility. LifeGuide is the only independent multiple company life

insurance software with this important feature.

-T100: All available forms of "T100" including

Guaranteed T100, Adjustable T100 and Unique T100. T100 is researched,

compared and quoted for single lives, on a joint (first and last to die

basis) as well as for multiple persons using LifeGuide's unique

Multi-LifeŽ cost optimization functions. Additional functions for

research and comparison of T100 insurance include fine tuning and

filtering of T100 products to account for the various category-classes,

including consideration of the various forms of past or present tobacco

use (and time since last use), detailed qualification requirements,

detailed underwriting evidence requirements, detailed plan

descriptions, insurance company profiles, marketing information

resources listings and instant access to sample policy wordings, etc.

LifeGuide provides subscribers with the most comprehensive and most

advanced T100 research and comparison tools.

-Whole Life: All available forms of Whole

Life, including Guaranteed Whole Life, Adjustable Whole Life, Unique

Whole Life and "limited premium payment period" Whole Life. Whole Life

is researched, compared and quoted for single lives, on a joint (first

and last to die basis) as well as for multiple persons using

LifeGuide's unique Multi-LifeŽ cost optimization functions. Additional

functions for research and comparison of Whole Life insurance include

fine tuning and filtering of Whole Life products to account for the

various category-classes, including consideration of the various forms

of past or present tobacco use (and time since last use), detailed

qualification requirements, detailed underwriting evidence

requirements, detailed plan descriptions, insurance company profiles,

marketing information resources listings and instant access to sample

policy wordings, etc. LifeGuide also shows Cash Surrender Values and

Paid Up Values for Whole Life on a year by year basis. This provides

for enhanced accuracy and credibility of of comparisons for any given

points in time. LifeGuide provides subscribers with the most

comprehensive and most advanced Whole Life research and comparison

tools.

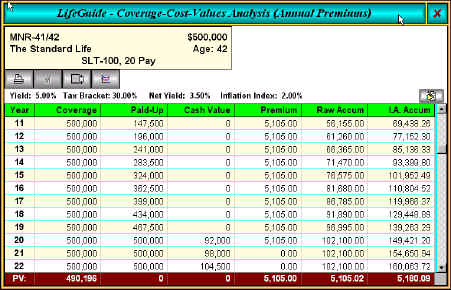

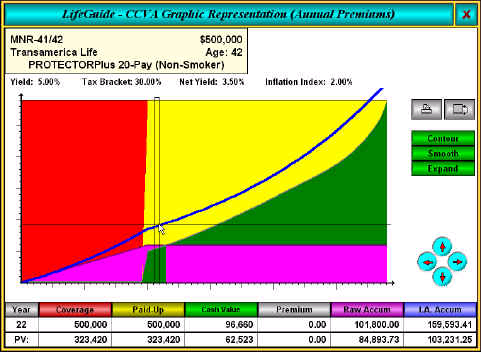

LifeGuide provides the user with detailed, attractive and easy to use

'ledger style' displays and print outs of values for any product being

compared. The above picture is a shows the CCVA functions 'ledger

style' display of values for a 20-pay Whole Life policy.

"A picture speaks a thousand words" (or a thousand entries on a

spread-sheet). The dynamic graphics illustrations functions of the

LifeGuide Professional Software provide the user with the easy to use

facilities to display and investigate any product in the comparison in

a pictorial and dynamic graphic format. By clicking at any point on the

LifeGuide dynamic graphic display, the values for that point are

instantly displayed in the 'read out' lines below, accurately for any

given year and for each aspect. LifeGuide is the only independent

multiple company life insurance software with these advanced, valuable

and easy to use facilities. Of course, you may print out the graph with

a single mouse click.

-Universal Life: All available forms of

Universal Life, including Level Death Benefit and Increasing Death

Benefit products and including all forms of COI. LifeGuide provides

detailed research comparisons for Universal Life solving for various

scenarios, including level payments for life, user-chosen "limited

premium payment period", for "target" premiums for user-stipulated

values and/or coverage at any given point in time, etc. Using LifeGuide

to research the Universal Life market easily saves countless hours (and

perhaps even days) of work and allows the subscriber to "zero in" on

the best product(s) for the client's needs. The user can then proceed

to produce the illustration for the consumer with the identified

insurer's marketing materials. This is one of the many aspects that

provide LifeGuide subscribers with a very wide and substantial

advantage over their competitors. LifeGuide is the ONLY independently

produced multiple company life insurance software with the power and

sophistication needed for comprehensive instant research of Universal

Life products. Universal Life Life is researched, compared and quoted

for single lives, on a joint (first and last to die basis) as well as

for multiple persons using LifeGuide's unique Multi-LifeŽ cost

optimization functions. Additional functions for research and

comparison of Universal Life insurance include fine tuning and

filtering of Universal Life products to account for the various

category-classes, including consideration of the various forms of past

or present tobacco use (and time since last use), detailed

qualification requirements, detailed underwriting evidence

requirements, detailed plan descriptions, insurance company profiles,

marketing information resources listings and instant access to sample

policy wordings, etc. LifeGuide also shows Fund Values and Cash

Surrender Values for Universal Life on a year by year basis. This

provides for enhanced accuracy and credibility of of comparisons for

any given points in time. As noted, LifeGuide is the only independent

multiple company life insurance software with the capability to

comprehensively research and compare Universal Life products.

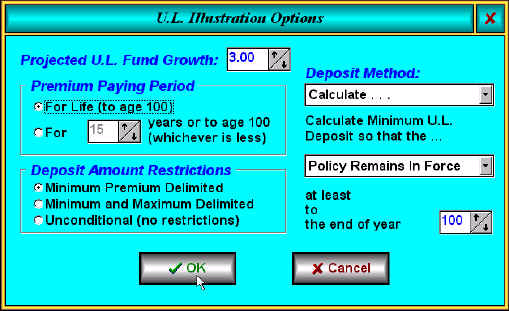

Picture of one of the pop-up 'options windows' in LifeGuide. This

'options window' appears when Universal Life products are to be

researched and compared and is designed for the user to indicate the

basis and parameters on which the UL research and comparison is to be

made. The user may set the assumed projected annual UL fund growth, the

planned premium payment period, the goals parameters to be solved for,

etc. Comprehensive comparisons and evaluations of UL - including

accounting for "fund" and "cash" values - requires complex computations

and programming logic. LifeGuide is the only independently produced

multiple company life insurance research software with the power and

sophistication that is required for such the research and comparison of

Universal Life products.

-Critical Illness: Needless to say, Critical

Illness (CI) coverage is of fundamental importance and bridges the gap

between life insurance and DI. Naturally, therefore, LifeGuide provides

subscribers with advanced and comprehensive facilities to research and

compare the large and growing number of CI products on the Canadian

market. LifeGuide covers the entire range of CI products, including the

"renewable term" and "level duration premium" products, including

products that offer ROP ("Return of Premium"). Since CI products vary

with respect to the covered CI events and since premium cost is closely

related to the extent of coverage provided, LifeGuide provides the

needed facilities to zero in on the products that provide coverage for

the CI events that the client would like to have covered. Additional

functions for research and comparison of CI products include the fine

tuning of the research for the various underwriting category-classes,

including consideration of the various forms of past or present tobacco

use (and time since last use), detailed qualification requirements,

detailed underwriting evidence requirements, detailed plan

descriptions, insurance company profiles, marketing information

resources listings and instant access to sample policy wordings, etc.

LifeGuide is the only independent multiple company life insurance

software with all these facilities for professional comparison and

research of CI products.

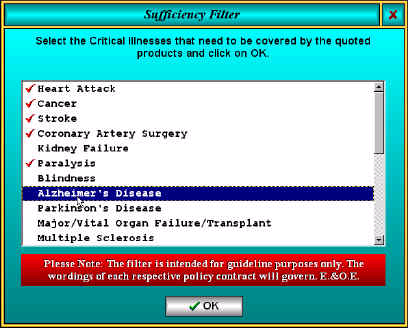

The Critical Illness Coverage comparison and research "Sufficiency

Filter" pop-up menu window of the LifeGuide Professional Software. This

menu window provides the user with the facility to indicate the

critical illness events that would need to be covered by each of the

products included in the comparison. The user selects the critical

events that need to be covered by clicking on the listing to place a

check mark next to the name of the critical events.

-Long Term Care insurance (LTCi): LifeGuide is the first - and only - independently produced multiple company professional software in Canada to include research and comparison of LTCi products. LTCi coverage is becoming increasingly important as the leading edge of the "baby boom" generation is approaching the senior stage of life, a stage of life where the potential for the need to fund long term care is a reality. Independent multiple-carrier, multiple-plan LTCi coverage research and comparison in LifeGuide is provided the leading edge LTCiScout(tm) software module that is included with LifeGuide. The software examines various aspects of LTCi offerings, including "Elimination Period", "Maximum Benefit Period", "Maximum Benefit Payout", Coverage environment(s), including "Home Care", "Facility Care", etc., "ROP", "Inflation Protection", "Premium" amounts, mode and duration, "Paid up" options, etc. LifeGuide's MontAge(tm) functions are utilized for effective and easy to use 'side by side' comparative examinations. Of course, LifeGuide's LTCiScout module also includes detailed narrative plan descriptions, qualification guidelines, issue evidence requirements and sample policy contracts for the various products being compared. Hundreds of LTCi offerings' permutations are included on LifeGuide's LTCiScout(tm) module, making this the most comprehensive independent resource for research and comparison of LTCi products available in Canada.

-Special and "Niche" products: LifeGuide

includes a growing number of special and "Niche" products. This

includes "Guaranteed" and "Simplified" issue life insurance and CI

products. For these products, as for the others noted earlier,

LifeGuide provides detailed plan descriptions, insurance company

profiles, marketing information resources listings and instant access

to sample policy wordings, etc.

Comparison Options

LifeGuide provides the user with the most advanced facilities to

compare the entire range of life insurance, CI and LTCi products,

including:

a. Initial and renewal premiums for term insurance, as well as detailed

year by year death benefit and values detail for "permanent" products,

including CSV and RPU for Whole Life products and Fund Values and Cash

Values for Universal Life products.

b. All four premium payment modes, including "Annual", "Semi-Annual",

"Quarterly" and "Monthly"

c. "Opportunity Saver": Where otherwise the "face amount" and/or the

calculated premium would fall below insurance company stipulated

minimums, the Opportunity Saver functions automatically compute the

increased the face amount that would be required to meet insurance

company stipulated "minimum premium" and/or "minimum face amount"

requirements. Particularly for younger and healthy persons, the

Opportunity Saver functions reveal substantial potential cost savings

that can be achieved. "More for less" is sometimes possible, especially

with term insurance. Instead of taking the old short cut and branding

products "below minimum premium" or "below minimum face amount", the

Opportunity Saver functions are designed to identify and take advantage

of cost savings opportunities that can be achieved by increasing the

face amount.

d. Multi-SelectŽ: These functions provide the user with the ability to

compare, survey and quote products from multiple categories in a single

run. When combined with the unique Across the BoardŽ functions of

LifeGuide, these functions are very useful and powerful for producing

time value comparisons and evaluations among products from various

product groupings.

e. Across the BoardŽ: Taking advantage of the year by year premiums and

values information that is available on LifeGuide, these functions

provide the user with the ability to compare all products in a survey

against each other for the best cost and value at any given point in

time. To minimize the hazards of "Vanishing Coverage", these functions

also identify the final expiry years of term products as well as

potential premature expiries of Universal Life products. (Note:

Across-the-BoardŽ is a Registered Trademark of Equisoft

Inc. The Across-the-BoardŽ modules are available only on LifeGuideŽ and

on our US life insurance comparison software, CompeteUS(tm). No other

use of our Registered Trademark, Across-the-BoardŽ, is authorized by us

on any other life insurance comparison program)

g. Provincial Coding: Since not all companies are licensed in all

provinces and since not all products are necessarily offered in every

province, LifeGuide provides the user with the important facility to

identify the province in which the prospective insurance transaction is

to be commenced. This avoids accidental quoting of products that may

simply not be available in the respective province. Furthermore, the

provincial coding functions also automatically take into account the

differing Provincial Premium Tax rates and apply these to the premium

computations where applicable to produce, compare and display accurate

premium figures.

h. Comparisons for single lives and for groups of lives: In addition to

comparisons, surveys and quotations for individual lives, LifeGuide

also provides the user with the most advanced functions, including all

the above, for groups of lives. For two or more lives, LifeGuide is the

first independent multiple-company comparison software to innovate

quotations and comparisons for multiple persons on a Joint-Life basis

(for joint, first-to-die as well as joint last-to-die with premiums

payable to the first death and joint last-to-die with premiums payable

to the last death). LifeGuide, of course, continues to provide the most

powerful and most comprehensive surveys, comparisons and quotations for

Joint-Life and for all products that offer this option, including term,

T100, Whole Life and Universal Life. LifeGuide is also the first

independent multiple company software to correctly and accurately

implement the facilities to survey, compare and quote products that are

offered with combined billing discounts. LifeGuide accurately computes

and attributes the combined billing discounts. Furthermore, LifeGuide

is the only independent multiple company software with the facilities

to automatically differentiate between the "individual policies

combined billing discounts" and the combined billing discounts that are

offered in single contract "base:rider" arrangements. This

differentiation is very important due to the potential contractual

flexibility limitations that may be present in "base:rider" combined

billing discount arrangements.

LifeGuideŽ is the ONLY independent multiple company software with the

very powerful Multi-LifeŽ functions. While the combined billing

discounts are based on the pre-brokerage "single company

representation" model and usually involve the policy factor, the

significance of the discount in combined billing discounts arrangements

diminishes with older individuals, higher face amounts and underwriting

qualification differences between the individuals. Furthermore,

combined billing discounts are not necessarily offered on all products

and product combinations, even within the same company. The LifeGuide

Multi-LifeŽ functions take into account both the combined billing

discount opportunities and the cross-company / cross-product

opportunities. The powerful and effective Multi-LifeŽ functions

frequently reveal significant cost savings and value enhancing

opportunities that would otherwise be missed.

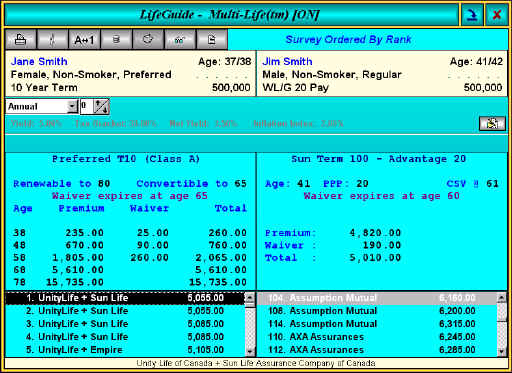

Picture of the Multi-LifeŽ functions display window of the LifeGuide

Professional Software. In this example, insurance is researched for a

husband and wife taking advantage of the Multi-LifeŽ functions' power

to compare on the basis of placing both with the "same" company or

placing each with a different company. Placing both insureds with the

same company could have the advantage of any offered combined billing

discounts while placing each with a different company may produce even

greater total cost savings. Both options need to be examined to

investigate and identify the optimum opportunities for cost savings.

The LifeGuide Multi-LifeŽ functions perform this research and

investigation instantly. In the pictured example, over $1,000 of annual

cost savings - achieved by insuring each of the spouses with a

different company - are identified. Without the LifeGuide Multi-LifeŽ

functions, these substantial savings could easily be missed.

LifeGuide is the ONLY independent multiple company software with the

powerful Multi-Scope(tm) functions. These functions provide the user

with the ability to survey, quote and compare insurance costs,

INCLUDING AVAILABLE DISCOUNTS for groups of lives numbering up to 12

lives in a single pass.

Financial Tools

The LifeGuide Professional Software provides a suite of easy to use

financial tools. These include:

-PV of a series of future payments

-PV of a single future payment

-FV accumulation of a series of periodic deposits at a given ROI

-FV of a single deposit at a given ROI

-Commuted Value

-Commuted Period

-Commuted Rate

-Cash flow and ROI analysis (involving both periodic deposits and

withdrawals at different or the same frequencies)

-Mortgage and/or loan analysis, including effective and powerful

studies of custom (user stipulated) static and/or variable payments

and/or mixture thereof (and with user-stipulated compounding and

payment frequencies, terms and amortization periods). Detailed displays

and print outs of schedules, etc. This software alone is valued at $250

and is included free of charge for the benefit of LifeGuide subscribers

and their clients

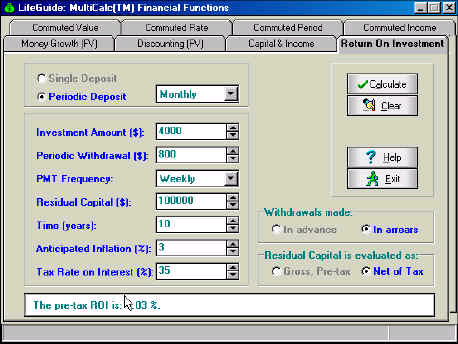

Screen view of one of the tabs "Return on Investment" of the LifeGuide

Multi-Calc(tm) financial tool functions. Different tools are invoked by

a single mouse click on any of the tabs.

Analysis Tools

-Detailed and comprehensive step-by-step "wizard" guided Life Insurance

Needs Analysis (a very effective and beneficial planning and service

tool)

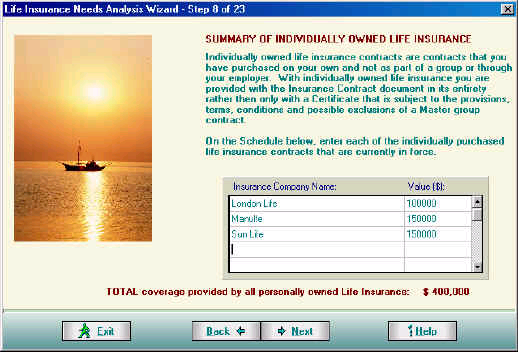

Picture of step 8 of 23 of LifeGuide's "wizard" guided Life Insurance

Needs Analysis. This step, to take inventory of existing individually

owned life insurance, provides an explanation in plain language as do

the other steps of LifeGuide's professional needs analysis modules.

-"Ledger Style" Life Insurance Needs Analysis with the same detail and

accuracy as the "wizard" guided format but on a "ledger" format (under

both the step-by-step "wizard" guided format or the "ledger" style

format, income streams are analyzed for increasing ("indexed") income

(eg to account for anticipated inflation), fixed income, fixed period

of income, indefinite period of income (capital preserved to provide

for indefinite income period). The capital at commencement of can be

set to deplete over a given period of time or to be preserved or to

actually increase with or without increased income cash flow.

-Detailed and comprehensive retirement income needs analysis and

analysis of investment(s) required to achieve the retirement income

goals. The Retirement Income Needs Analysis is provided in both the

"wizard" guided step by step format as well as in the "ledger" format.

Income streams are analyzed for increasing ("indexed") income (eg to

account for anticipated inflation), fixed income, fixed period of

income, indefinite period of income (capital preserved to provide for

indefinite income period). The capital at commencement of retirement

can be set to deplete over a given period of time or to be preserved or

to actually increase with or without increased income cash flow.

Picture of the "ledger style" format, this one for the Retirement

Income Needs Analysis. This scrollable window is neatly organized to

detailed and comprehensive needs analysis and provides access to

various detailed cash-flow ledgers for optional scenarios.

-Detailed and comprehensive disability income needs analysis in choice

of formats similar to those for life insurance and retirement needs.

Additional Resource Tools:

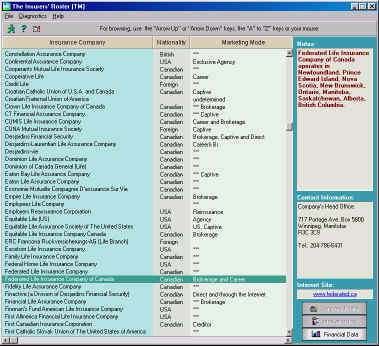

-The Insurers Roster: The most comprehensive and detailed roster of

nearly 400 insurers that are operating or have operated in the past in

Canada. The Roster includes a host of valuable information to trace the

insurer who may be handling a product of a "retired" insurer, including

contact information. The Roster also includes contact information,

financials and brief details with respect to currently operating

insurers. LifeGuide is the only independently produced multiple company

software in Canada that provides this important resource tool.

Picture of the "Insurers' Roster" functions window of the LifeGuide

Professional software. Companies are listed in alphabetic order, with

detailed information on each easily accessible with a single mouse

click or through the keyboard. Nearly 400 companies that are operating

or have operated in Canada in the past are listed and detailed to

provide added benefit to LifeGuide subscribers and their clients.

-Click and view instant retrieval of information over the internet,

including links to insurer web sites, to insurer information circulars,

to LifeGuide Lines, etc.

-Financial Library, including resource data on various aspects of life

insurance and financial planning -EZ setup and use links to individual

company and other third party software, directly from within LifeGuide

... and more

LifeGuide Screen and Print "Output"

LifeGuide screens are designed for ease of use and to minimize the

number of screen flips/changes. Detailed information on any product in

a LifeGuide comparison survey is instantly displayed within the survey

screen on a single mouse click. The user can also continue on and zoom

in on any aspect of the product, including quantitative and qualitative

details, dynamic graphic illustrations, etc. - usually with only a

single mouse click.

LifeGuide Print output is attractive and professional. The user is not

limited to a narrow range of print output options but can custom

produce the print output to provide extensive research and specific

product(s) detail, including both quantitative and qualitative

information and including graphic illustrations.

Print output can be instantly directed by the user to any physical or

virtual printer (including "printing" to a file and saving of that

file). LifeGuide also features its own specially custom written module

to produce print output in PDF format with or without instant e-mailing

of the output. Although Adobe's PDF writer is an excellent and strongly

recommended product, production of professional output in PDF format

with LifeGuide does not require the user to purchase a PDF writer

separately.

Software Upgrades and Data Updates

While already providing subscribers with a wide and significant service

and competitive advantage, the LifeGuide Professional Software is

enhanced on an ongoing basis to continue to widen the service and

competitive advantage of subscribers.

Software upgrades and data updates are released on a monthly basis, an

on occasion on an interim (during the month) basis as well. Since we

work independently but cooperatively with the various insurers, we

normally receive insurance product change, introduction, underwriting

requirements, qualification requirements and like information ahead of

introduction to the field. This allows us to include such changes,

introductions and the like simultaneously with the insurance companies

themselves and enhances the accuracy and currency of the LifeGuide

Professional Software. This cooperation by the insurance companies is

very much appreciated and benefits the thousands of LifeGuide

subscribers as well as the insurers and the general public.

Software upgrades and data updates are distributed by CD as well as by

fully automated, secure and reliable downloads from the LifeGuide

update servers. The upgrades and updates via the Internet are

hassle-free and fully automated, utilizing special routines innovated

for the LifeGuide Professional Software and built into the software

itself.

Information Resources:

Product information, including rates, methods of computation, u/w

requirements, descriptions, qualification criteria, etc. are sourced

directly from the head offices of the insurance companies. This

provides the highest possible degree of accuracy and reliability.

Furthermore, since the information is received directly "from the

source" and in a timely manner, the need for "mid-month" updates is

limited. We thank all the insurance companies for their ongoing support

and cooperation.

Important Note:

The above is only a very brief review of a small fraction of the

benefits and advantages provided by the LifeGuide Professional

Software. LifeGuide provides many features and benefits that are not

mentioned here, each adding to and compounding the wide and notable

service and competitive professional advantage enjoyed by LifeGuide

subscribers.